The Long Road to Tax Transparency

A new proposal for public tax reporting is being considered. It's just the latest in a long campaign that, despite setbacks, never seems to go away.

The usually boring world of 401(k) and retirement management has gotten unexpectedly hot recently, finding itself smack dab in the middle of the battlefield known as America’s “Culture Wars.”

The target for the right is “environmental, social and governance” (ESG) factors in investing–what was previously a growing trend for fund managers who claimed they were being socially conscious, as well as prudent, in making investments. President Joe Biden recently exercised his first veto on H.J. Res 30, which disapproved of a Department of Labor rule allowing retirement managers to use ESG factors in decision-making. Some states have also banned such considerations from state retirement plans. In the meantime some of the biggest funds are walking back from ESG, claiming it’s not in the financial interests of their clients.

The basic ESG concept bears some resemblance to religious funds which exclude objectionable investments such as alcohol or gambling. But ESG factors can include a wider array of issues, including not just the climate change impact but also corruption, human rights abuses, and a company’s commitment to diversity. To Republican critics, it amounts to “woke” investing–with someone else’s money. Maybe yours.

Does ESG include responsible tax-paying? It’s not one of the more prominent issues, to be sure. But the DOL rule does mention compliance with tax law, among others, as a factor that could be considered.

The ESG firestorm definitely rages in the background as the Financial Accounting Standards Board, the nonprofit body that sets reporting rules used by the Securities and Exchange Commission, considers new tax reporting rules that critics claim do more to appease activist and advocacy groups than investors.

The disclosure requirements wouldn’t be full country-by-country reporting–the transparency regime that’s been gaining momentum over the past decade as a way to make tax avoidance easier to pinpoint, by tax authorities if not the public. Country-by-country rules are already in place as confidential tax reporting requirements by most governments as part of a standard set by the Organization for Economic Cooperation and Development’s 2015 Base Erosion and Profit Shifting project. Public reporting requirements are in place for some sectors, such as oil and mining, while many nonprofit advocacy groups continue to push for them across the board.

The idea is that country-by-country reporting of various factors will reveal mismatches, indicating when a company has managed to move income to a low-tax jurisdiction without the economic activity to justify it. Perhaps the most significant indicators are taxes, income, and employee headcount–if you see substantial income without the other two in a single jurisdiction, it sure looks like something is funny. Companies may want to move away from that result, even if it’s legal (or justifiable), just to avoid audits from angry tax authorities and PR headaches if it gets out.

The FASB proposal would only include country-by-country reporting of taxes paid, if they comprise 5% or more of a company’s total tax payments. That’s only one plank of the country-by-country reporting scheme, but it’s a big one, including both U.S. and foreign taxes.

Is this ESG reporting? The organization says no, it’s focused on the bottom line, and solely responding to requests from investors for more information about the tax risks of companies they’re investing in. Given how many countries are enacting new tax regimes, such as digital services taxes or provisions of the OECD’s global minimum tax, it’s not hard to imagine that this is a real demand.

But some are skeptical. The U.S. Chamber of Commerce pre-emptively sent FASB comments, before its proposal was even released, urging it to reconsider.

“The Chamber is concerned that recent demands for increased income tax disclosures derive from a politically driven narrative—namely, that corporations do not 'pay their fair share'—and are not based on an investor mandate,” the Chamber of Commerce wrote. “Disseminating information that is more governmental in purpose—and that is already being reported to the government—is the province of federal regulators and Congress, not FASB.”

The letter also demands that FASB reveal who it has met with while devising these rules, implying that they may have met with “non-investor activists.”

It’s worth noting that full country-by-country reporting is already part of the Global Reporting Initiative, one of the most-used benchmarks for ESG investing. It’s part of a longtime campaign from nonprofit advocacy groups and policymakers to get more of this information out there, through voluntary or legal means. Sen. Chris Van Hollen, D-Md., recently re-introduced legislation that would enact these reporting requirements into law. (He also tried to include it as a condition for companies receiving pandemic relief.) Sen. Van Hollen has also pressured FASB to consider these requirements in the past, and groups such as the Financial Accountability and Corporate Transparency (FACT) Coalition have made their case to the SEC.

Those groups can point to the fact that a form of country-by-country reporting has already been in place for oil, gas and other companies which harvest natural resources. This is part of a Publish What You Pay initiative that has gone back decades. Its motive is actually to root out corruption, not tax avoidance–these companies operate in the often poorer countries where these valuable assets can be found, yet the extraction never seems to benefit the people who live there. (A paradox known as the “resource curse.”) By requiring these companies to reveal how much they pay to governments–in taxes as well as more nebulous transfers–the public may get a better idea of how much is mysteriously disappearing.

Congress enacted these disclosure requirements as part of the 2010 Dodd-Frank bill, but due to persistent litigation from the oil industry, a reluctant SEC, and a Congressional vote to rescind the regulations in 2017, they’re only set to go into effect this year. That’s more than a decade after they were passed.

While the purpose may be different, the Publish What You Pay movement has gotten mixed in with the country-by-country campaign, and many oil/gas companies (such as Shell Plc) have begun to voluntarily release all of the info.

When taking in all of these initiatives, it feels like there’s a steady drumbeat towards inevitable full public disclosure. And practitioners will often admit that, and say they assume any of these reports could end up on the front pages.

Critics note that these simple figures could be misleading. Maybe a jurisdiction has high profits and few employees because they’re valuable research scientists, not because of tax planning. For that matter, some claim this whole system amounts to formulary apportionment, in effect if not law–countries could pursue these benchmarks through aggressive audits until they get them. If we’re headed towards an apportionment system–where taxable income is allocated according to factors such as assets or headcount, instead of arm’s-length pricing–let’s debate it out in the open.

They’ve got a point. But on the other hand, what does it say about the system now, if disclosure requirements alone are enough to shift payments?

FASB has looked at these issues in the past, but declined to enact them. The passage of the 2017 Tax Cuts and Jobs Act seemed to relieve some of the pressure for them to act, but obviously it never went fully away. We'll see how far it gets this time--but many will say that full public disclosure, one way or another, is only a matter of time.

DISCLAIMER: These views are the author's own, and do not reflect those of his current employer or any of its clients. Alex Parker is not an attorney or accountant, and none of this should be construed as tax advice.

LITTLE CAESARS: NEWS BITES FROM THE PAST WEEK

- The United Nations released this week about 90 comment statements on its plan to take a bigger role in global tax rules from 24 different countries (and coalitions such as the European Union), as well as dozens of independent organizations, business affiliations, and various tax experts. They break down pretty much as you'd expect--developed countries strongly support keeping the OECD as the top rule-setter, developing countries and NGO groups strong support shifting these discussions to the UN, and countries like China and India are more equivocal. Still, there's lots of interesting reading here, and the sheer volume is interesting. I'm still not sure how seriously to take this latest movement--as I wrote last year, it seems like this debate has been raging forever--but at least it's getting some attention.

- Several U.S. business groups, such as the U.S. Chamber of Commerce, the National Foreign Trade Council and the Computer and Communications Industry Association penned a letter blasting Canada's new planned digital services tax, among other policies that could affect American digital businesses. Ostensibly the letter was sent to President Biden as he visits our neighbor to the north, but clearly the audience includes Canada's prime minister and parliament. Nothing terribly new here, but it shows that digital businesses are getting more aggressive battling DSTs individually as the OECD's Pillar One (meant to discourage them) fades further and further into the rear-view mirror.

- "Treaty-shopping" means routing transactions through countries to take advantage of their double tax treaties. Treaties are the arteries of the international tax system, but you can't just use them without a justification. The OECD BEPS project included new rules to prevent treaty-shopping, and on Tuesday the organization released a new "peer review" report outlining progress made in implementing those new restrictions. The report states that the system is moving ahead but there is "uneven" implementation, especially among countries that did not sign the "multilateral instrument," an agreement to alter existing double tax treaties to add the new language.

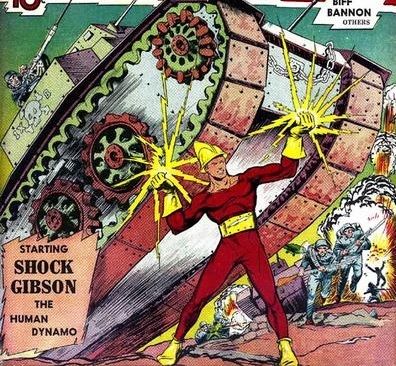

PUBLIC DOMAIN SUPERHERO OF THE WEEK

Shock Gibson, the Human Dynamo, first appearing in Speed Comics #1 in 1939. Yet another superhero born from a lightning strike, David Gibson gained the ability to direct electricity after his laboratory was struck by lightning. (Yes, he uses his real last name while superheroing.) He first used his superpowers to fight crime, but eventually joined the Allies to help defeat the Nazis in WWII.

Contact the author at amparkerdc@gmail.com.