Is a Pillar Two Trade War Inevitable?

Republicans have declared war on the OECD's global minimum tax--and in a few years they may be able to fight it.

Members of Congress introduce a lot of bills–most of them aren’t fated to go far.

That likely includes the Republican bill to punish companies in countries that enact parts of the Organization for Economic Cooperation and Development’s “Pillar Two” 15% global minimum tax. The bill is meant to discourage countries from enacting the under-taxed profits rule, which could tax U.S. companies if their income ever falls below 15%.

While it was endorsed by all Republican members of the House Ways and Means Committee, it was not included in a recent package of tax proposals which the committee advanced for a full vote on the House floor.

The House may eventually get around to passing it, but it would hit a dead end in the Senate, still controlled by Democrats. President Biden, obviously, would be unlikely to sign it, given that the OECD agreement was negotiated by and championed by his administration. And if Republicans somehow forced it down the Democrats’ throat–perhaps as part of an agreement to avoid a government shutdown in September, for instance–I have doubts that it would ever really work. Laws like this raise all sorts of administrative questions, especially if it’s implemented by a reluctant executive branch.

The main reason it’s not likely to become law, however, is that it’s largely superfluous. Already, there are several provisions on the books that could give the president the power to retaliate economically, through tariffs or increased tax rates, for alleged discrimination abroad.

That’s why the bill is significant, even if it’s just a proposal. It’s a full declaration of war by Republicans against Pillar Two, and it indicates a willingness to use whatever means are necessary to undermine it. To follow through, the GOP likely only needs to win the White House.

Whenever that happens, it could trigger what amounts to a trade war between the U.S. and the countries that are most aggressive about enforcing the full OECD agreement. Since, throughout American history, neither of the two major political parties have stayed out of power for very long, this could mean that the OECD agreement is in for a rocky future, unless things dramatically change.

While Republicans have criticized the agreement in full, they’ve targeted the UTPR because it’s the law that would actually tax U.S.-headquartered companies. It’s meant to be a rarely-used “backstop” provision, but since the U.S. missed its chance to pass OECD-compliant legislation, it’s likely to be a frequent headache for U.S. companies.

It theoretically could be used by any foreign country where a U.S. company has a subsidiary with some amount of assets and employees–even when that subsidiary itself is paying adequate tax. The UTPR applies any time an entity in that parent corporate group pays less than 15% tax, even if it’s in the U.S. A low effective tax rate is prima facie evidence of profit-shifting, under this system, and countries where real substance exists get to pick some of it up. But Republicans claim this is a double insult–not only is it hitting American companies’ bottom lines, but it’s ceding the U.S. tax base to foreign jurisdictions.

The GOP legislation doesn’t mention the UTPR specifically, but it targets countries with taxes that are “extraterritorial” or “discriminatory,” adjectives that Republicans have applied to the UTPR. The legislation lays out definitions for these terms that are sure to include the UTPR, but include enough exceptions to avoid anything else, in theory. The law would then hike existing taxes on companies based in those countries, that could ultimately reach as much as a 20 percentage point increase.

Perhaps not coincidentally, that language–”extraterritorial or discriminatory”--shows up in an existing law that does largely the same thing as this bill. The main difference is that it gives the president discretion on when to apply it. Section 891 of the Internal Revenue Code allows Treasury to double the income tax rates for citizens or corporations of a country that has enacted “extraterritorial or discriminatory” taxes on U.S. citizens or corporations. It’s not “up to double”--the bill specifically double the rates, unless the amount of tax equals 80% of the taxpayer’s income. (Weirdly enough, this obscure code section was uncovered in 2016 by Georgetown Professor Itai Grinberg, who led Treasury’s OECD negotiations from 2021-22, as a potential response to the European Union state aid investigations into U.S. tech companies.)

According to Joe Thorndike of Tax Notes, Section 891 was enacted in the 1930s amid tax tensions with France–one of the countries that is today implementing the OECD agreement. But it’s never been invoked. That’s no guarantee that a future administration wouldn’t look to it as a potential tool, as the Obama Administration did with Section 385 (also an obscure, then-dormant provision) in 2016. But the lack of any case law or precedent may lead Treasury to consider other options.

One of those options could be Section 301 of the 1974 Trade Act. This isn’t tax law, but trade law, something I don’t have a ton of experience following. But all international tax journalists have gotten to know Section 301 a bit after the Trump Administration used it to threaten countries enacting digital services taxes with retaliatory tariffs. Section 301 applies when the government determines that a country has taken an “unjustifiable” or “unreasonable” action that burdens U.S. commerce.

In theory, the 301 process is slow and deliberative, involving many federal departments and public hearings. But the Trump administration showed that if it’s a high priority, the White House has a lot of power to use 301 whichever way it chooses.

Traditionally, tax and trade exist in their separate spheres, dealt with in parallel systems. But that divide has been breaking down in recent years, and Trump's 301 investigations into DSTs are arguably an example of that--DSTs were enacted as patches to the income tax system, at least according to the countries that used them. Unlike DSTs, the UTPR is a rule recommended by the OECD, which is the agreed-upon standard-setter for global income taxes. That would likely be taken into account by trade bodies such as the World Trade Organization in determining whether retaliation is justified--but the 301 process has become untethered from the WTO in recent years, as the U.S. charts its own course.

A Section 301 action would involve tariffs, rather than income tax increases, and that difference could matter. But in practice it could be a largely similar result–significant economic consequences for those companies and, in theory, their home country.

Much like it has with its war-making authority, Congress has slowly ceded control of its constitutional power to set trade policy, happy to let the president deal with the tricky details of international negotiations while it harangues from the sidelines. And the Donald Trump-led populist MAGA movement has also precipitated a dramatic U-turn in the Republican philosophy on trade, dropping a commitment to free trade principles in favor of robust protectionism. Whether the next GOP president is Trump or one of his rivals, he or she is likely to continue to explore how the executive branch can flex its muscles on trade issues.

Although once this becomes a real policy and not just rhetoric, lawmakers could face some of the consequences. A tax on the U.S. subsidiaries of foreign multinationals is essentially a tax on foreign investment in the U.S.--it’s likely to harm the U.S. economy as much or more than the parent’s jurisdiction.

The goal of retaliatory action isn’t necessarily to enact these taxes, but to use the threat to convince other countries to reconsider. I’m not really sure whether it would be enough to get countries to change course this late in the game. But the chances for more discord, when the goal of the OECD’s project is to reach a global consensus, could push policymakers to seek solutions.

Some way of reducing the chances that U.S. companies would be targeted by the UTPR–perhaps by a safe harbor or further flexibility on the definitions of credits–may not be enough at this point to get Republicans to back down. But it could reshuffle where this issue stands in the list of political priorities. American politics today can be harsh–but also fickle.

DISCLAIMER: These views are the author's own, and do not reflect those of his current employer or any of its clients. Alex Parker is not an attorney or accountant, and none of this should be construed as tax advice.

LITTLE CAESARS: NEWS BITES FROM THE PAST WEEK

- Happy (belated) July 4th to my American readers, and happy summer to everyone else. This is looking to be a big month for Pillar One, the other part of the OECD project, which is meant to deal with DSTs. Officials from the organization have said they hope to issue text for a multilateral convention (i.e. treaty) by the end of the month, which countries can then begin to implement through their particular legal processes. If they deliver, the project will finally move forward after years of delay, and they may begin to look at interim guidance, including what countries with DSTs should do in the meantime. If they can’t reach a consensus, then the debate will likely move on to which parts of the project can be salvaged, and countries may begin to look for other ways to deal with the standoff over DSTs. Either way, there’s still no apparent answer for how the project can succeed if the U.S. never ratifies the agreement, given strong opposition among Republicans in Congress.

- The International Monetary Fund issued a paper Wednesday looking at tax issues with cryptocurrencies, finding that the “quasi-anonymity” of cryptos poses a difficult challenge for tax authorities. This isn’t exactly breaking news–the IRS has been dealing with these questions since 2014–but the IMF paper provides a brief yet comprehensive overview of the issues, including evasion in income and capital gains tax, sourcing challenges with VAT/consumption taxes, and how to incorporate them in a carbon tax framework given the huge energy impacts of crypto-mining operations.

- The OECD on Thursday issued a report on tax transparency in Africa, especially regarding exchange of information and anti-evasion measures. Echoing the report the organization issued last week on the same issues and Latin America, the Africa report found that the continent as a whole has made gains in tax enforcement, but those gains are uneven given the lack of resources and expertise for many of the tax administrations.

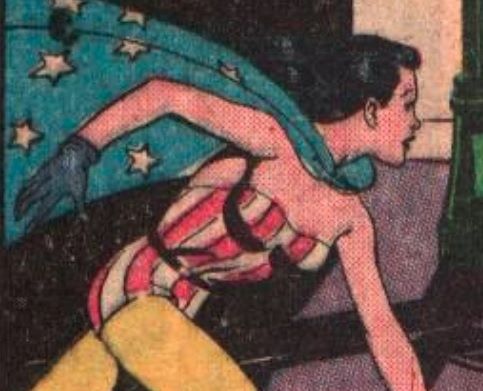

PUBLIC DOMAIN SUPERHERO OF THE WEEK

Every week, a new character from the Golden Age of Superheroes who's fallen out of use.

Yankee Girl, who first appeared in Dynamic Comics #23 in 1947. For reasons unknown, Lauren Mason turns into a patriotic superhero whenever she says "Yankee Doodle Dandy." Good thing she doesn't have to sing the whole song!

Contact the author at amparkerdc@gmail.com.