Kamala and the Global Minimum Tax

If Democrats are victorious, how serious are they about preserving Biden's signature accomplishment on international taxes?

The U.S. presidential election is going right down to the wire as one of the closest in decades. (Which is saying something, since it seems close every year.)

Not all of my subscribers are Americans. But I bet most of you have been keeping an eye on the race. The American president has effects far beyond the U.S. borders—never more so than with our last one, the bombastic Donald Trump.

I’m not sure how widely the rest of the world follows the U.S. congressional races, however. Depending on how the presidential race swings, the Republican Party may hold on to its microscopic majority in the U.S. House of Representatives, but it’s seen as somewhat of a long shot. Democrats, on the other hand, face an uphill climb to hold onto the Senate. Due how six-year Senate terms are staggered, more Democrats than Republicans are up for re-election this year. Despite the heroic efforts of some Democratic senators to win over red state voters—including Sen. Sherrod Brown, my former congressman, whose Rust Belt appeal and political talent may be enough to save his seat—at least a few seem doomed to lose, and at that point the math just doesn’t work.

So, if Vice President Kamala Harris does win next month, it’s more likely than not that she’ll preside over a divided Congress and government. That will make delivering on all her lofty campaign promises on taxes impossible. But the expiration of several provisions of the 2017 Tax Cuts and Jobs Act will set up a “tax cliff,” forcing the parties to come to an agreement or see popular policies vanish. The timeline gives Democrats some leverage to push for their preferred tax policies.

Including, perhaps, implementation of the Organization for Economic Cooperation and Development’s Pillar Two 15% global minimum tax. The agreement was finalized by the Biden Administration and is seen as one bit of unfinished business from President Biden’s first term, and it aligns with Democratic priorities to make the tax code fairer while also raising more revenue. This would likely be the last, best chance for Congress to enact changes to the global intangible low-taxed income regime, to bring it closer enough to the OECD system to be seen as in compliance.

But that’s far from assured. The 2025 Tax Cliff will be a complex and difficult game of chess, forcing both parties to decide on their top necessities and likely discard anything else. Heartbreaking sacrifices will be inevitable if there’s any deal to be had.

In that environment, it’s worth asking—how committed to Pillar Two would a President Harris be?

The answer’s not quite as obvious as you might think. As she’s made pains to emphasize on the campaign trail, Harris isn’t Joe Biden, and she won’t have the same feeling of ownership over the agreement as her current boss.

Also, virtually everyone at the U.S. Treasury Department involved in negotiating and finalizing the agreement has left—aside from current Treasury Secretary Janet Yellen, who may well decide to stay on. But she was only involved at a high level, and isn’t necessarily as invested in it as her staff.

With any new administration comes new people, who are likely to give the policy some fresh readings.

But perhaps most importantly, it isn’t necessarily true that enacting Pillar Two would bring in the kind of cash that could help Democrats pay for other priorities they hope to see included in a 2025 tax deal. This isn’t 2016, when piles of offshore cash held by U.S. companies helped pay for a reduction in the corporate tax rate. The TCJA, as well as other international tax reforms, have put a serious dent in the scale of profit-shifting.

Which isn’t to say that enacting Pillar Two wouldn’t be a nice bonus for Democrats. The question is, will they be able to afford it when crunch time arrives?

Rather than new revenue, the biggest incentive to implement Pillar Two could be to protect American companies from foreign taxes which may apply if the U.S. is seen as out of compliance. That could be a big enough reason in its own right—even Democrats don’t want to see U.S. companies taxed unnecessarily, especially by other governments. It could also make the agreement more durable, removing one of the key Republican criticisms and reducing the backlash against the OECD.

However, this could also involve some more complex negotiating. Even under the best conditions, it’s unlikely that Congress could pass Pillar Two wholesale. That would require sweeping away existing tax regimes like GILTI and the corporate alternative minimum tax, and enacting Pillar Two-modeled legislation word-for-word. What would probably happen instead is that Congress would enact some specific changes to GILTI, including making it apply on a country-by-country basis, closing the gap towards the Pillar Two system. The U.S. could then push to be grandfathered into the system and be considered in compliance, which would turn off enforcement taxes like the undertaxed profits rule.

Other OECD countries, which have lost their patience in dealing with the demanding and stubborn U.S., would probably be much more agreeable to an exemption if Congress made some initial moves towards implementation. But would that be guaranteed? If some of the trickier outstanding issues, like how to treat the U.S. research and development credit, remain unresolved, there could be significant hurdles.

And would Congress take these steps without a guarantee that it would turn off the UTPR? This is a classic “After you, Alphonse” problem.

On the other hand, Pillar Two’s fate should Donald Trump return to office may seem much simpler. Republicans have been outspoken in their opposition to the agreement, and Trump himself seems to loathe anything with his successor’s fingerprints on it.

But I don’t take that as a given, either.

First of all, Pillar Two is likely to continue in other countries regardless of what the U.S. does. There’s only so much U.S. bluster can do to hold it back.

Trump has a brutal, zero-sum, Darwinian view of the world, in which there are few overriding principles, just winners and losers decided by the cold exercise of power. He would no doubt relish the chance to punish countries using Pillar Two rules to tax U.S. companies with economic sanctions—something that current U.S. law gives the president wide latitude to do without Congressional authorization.

But Trump is so in love with tariffs, promising to enact them indiscriminately worldwide, those specific actions could get lost in the noise. (And don't forget retaliatory tariffs against Pillar One taxes, something that even Biden has reserved as an option.)

Trump also fancies himself as a dealmaker—indeed, that’s part of why his administration pursued the Two-Pillar project in the first place. If there are opportunities to move away from Biden’s framework and redefine Pillar Two as his own, he may see that as a victory.

He’d also probably need to work with a divided Congress, so throwing the Democrats a concession or two may be necessary to preserving the tax law that was one of the signature accomplishments of his first term.

So, whatever happens in two weeks, the fate of U.S. participation in Pillar Two remains very undecided. For tax wonks, the tension will last for a while longer.

DISCLAIMER: These views are the author's own, and do not reflect those of his current employer or any of its clients. Alex Parker is not an attorney or accountant, and none of this should be construed as tax advice.

A message from RoyaltyStat:

RoyaltyStat® is the market leader in databases of royalty rates and service fees from third-party transactions to facilitate transfer pricing compliance and the valuation of intangibles. Our focus on high-quality data, unique transfer pricing analytics, and knowledge-based customer support makes us the choice of transfer pricing practitioners worldwide, including the top accounting and law firms, Fortune 500 multinational entities and more than 15 tax administrations. Find out more at royaltystat.com.

Thanks for reading! Don’t forget, you can sign up here for a paid Emperor Subscription, to get extra bonus content, including interviews with newsmakers in the tax field and deep dives on various international tax topics.

The Emperor Subscription will also give you access to past content, such as interviews with former OECD tax chief Pascal Saint-Amans, National Foreign Trade Council VP Anne Gordon, and former U.S. Treasury official Jason Yen.

On Friday, I talk to Leopoldo Parada, noted international tax expert and reader in tax law at King's College London. We will discuss the OECD Pillar Two agreement and its effect on the developing world.

The transactions are handled by Stripe, a safe and secure payment processing platform. Electronic receipt and invoice available. (If anyone has any difficulties subscribing, please let me know.)

You can sign up here for $8/month or an $80 annual payment. Please consider subscribing!

LITTLE CAESARS: NEWS BITES FROM THE PAST WEEK

- As I mentioned earlier—though you probably didn't need a reminder—the U.S. election is entering the final weeks. And as Trump nears the finish line, he's been offering tax breaks like Oprah, on everything from tips to Social Security payments to salaries for police and firefighters. Some of these are hard to take seriously, but in one case he's stumbled onto an interesting issue—taxation of Americans living abroad. Unlike most countries, the U.S. taxes all worldwide income of its citizens, even those who leave the country. (Unless they renounce their citizenship.) Aside from the extra tax payments, this can be an administrative headache for many expatriates, which can turn into a full-on nightmare since the enactment of the Foreign Accounts Tax Compliance Act and other enforcement measures. In many cases, it makes it all but impossible to open a foreign bank account. This is an issue that seems niche, but means the world to those who are affected. (Just mention it on Twitter and you'll be hearing from them.) Trump is now promising to end worldwide taxation, and while I doubt this would be a priority in his second term it adds the policy to the mix in 2025. Certainly, U.S. multinationals with personnel across the globe would be interested.

- A new, previously announced Internal Revenue Service unit dedicated to audits of pass-through entities (self-owned businesses or partnerships taxed at the individual level) is up and running, the agency announced Tuesday. This puts pass-through taxation firmly under the purview of the Large Business & International division, and is part of the stepped-up enforcement brought about through Inflation Reduction Act funding. Pass-through taxation has become a marquee issue since the TCJA granted a generous deduction on pass-through income, with complex safeguards against using it on normal labor income. This isn't exactly an international issue—the deduction is limited to domestic pass-throughs and the system actually incentivizes foreign entities to incorporate—but certainly brushes up against the international system.

- The National Foreign Trade Council is raising concerns about recent Treasury regulations on the taxation of gains or losses in foreign currencies. I'll admit, I know almost nothing about foreign currency rules, but I'm aware that this has been a long-simmering issue.

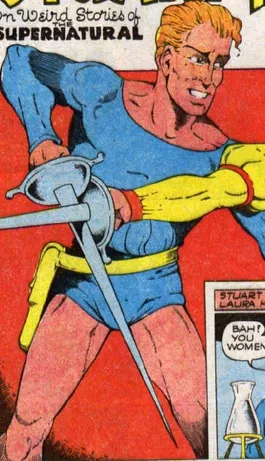

PUBLIC DOMAIN SUPERHERO OF THE WEEK

Every week, a new character from the Golden Age of Superheroes who's fallen out of use.

Stuart Taylor, first appearing in Jumbo Comics #1 in 1938. No nom de plume for this swash-buckling, time-traveling scientist's assistant, who honed his brawling and sword-fighting skills in combat across centuries. An early Jack Kirby creation demonstrating his taste for the fantastic, that would revolutionize comics decades later.

Contact the author at amparkerdc@gmail.com.