Racing Through 2025

Republicans won big last week, and with full control of Congress could race through a TCJA extension without Democratic help. But there are a lot of reasons why this won't be as easy as it sounds.

I’ve been writing about the 2025 Tax Cliff as a long, drawn-out process that could well stretch into 2026.

When it seemed likely that Washington would be divided, and some kind of bipartisan deal would be necessary to keep various tax hits scheduled into the Tax Cuts and Jobs Act from happening, that seemed like the smart bet.

However, this year in politics all smart bets are off.

As you may have heard, Donald Trump won his bid for a second, non-consecutive term as president, and Republicans did surprisingly well in Congressional races. They kept the Senate, and narrowly avoided relinquishing the House of Representatives, for full control of the levers of power.

Now, the talk in D.C. is that Republicans will be able to extend the TCJA through reconciliation, the process requiring only 50% approval from both Houses of Congress, that was used to pass the law back in 2017. They could also do this quickly–already some Republicans are touting it as part of their 100-Day agenda.

And they’ll be able to do it in a much more business-friendly way than a bipartisan deal would have required. Democrats would have almost certainly insisted on some new revenue as part of a deal, which was prompting even some Republicans to ponder raising the corporate rate from 21%.

Post-election, it seems possible for Congress to avoid a rate hike, while also repealing many of the provisions in the TCJA that hit corporate pocketbooks. Those include the 2026 increase in the tax on global intangible low-taxed income from 10.5% to 13.125%, and the rate on foreign-derived intangible income from 13.125% to 16.4%. The base erosion and anti-abuse tax will also become more onerous in 2026, something Congress could reverse.

Republicans will also likely try to repeal changes in the TCJA that have already happened, including the tightening of the limit on the deductibility of interest in Section 163(j), from 30% of earnings before interest, taxes, depreciation and amortization (EBITDA) to just 30% of EBIT. And companies will no doubt push for a return to the full deductibility of research and development costs, rather than the five-year amortization period. (The House passed a bill which would have done that for only domestic costs, but it failed in the Senate–now they may be able to do the same for both foreign and domestic R&D.)

And, while they’re at it, they could smooth out some of the troublesome (for businesses) parts of the TCJA that have been there all along. They could add net operating losses and foreign tax credit carryforwards to GILTI, for instance, while also ensuring that foreign tax credit limitations don’t apply. To fit the bill in the $1.5 trillion window mandated by the process in 2017, tax-writers wove in all kinds of weird little kinks to save revenue, at least on paper–now there’s a chance to take those out.

One thing that Congress probably won’t be doing is enacting changes to bring the GILTI tax in-line with the Organization for Economic Cooperation and Development’s Pillar Two global minimum tax, something that has become a bete noir for Republicans.

This could all happen well before summer, while President Trump is still getting reaccustomed to the White House.

But there are many reasons to doubt this rosy scenario.

All of this assumes that revenue won’t be an issue. Reconciliation doesn’t have any outright limit on how much the legislation can increase the deficit for the first decade. (After that, the Byrd Rule mandates that it not add to the deficit at all–so Republicans will have to set up yet another tax cliff in 10 years.)

During the campaign Trump promised to use tariffs to pay for further tax cuts, even suggesting that we could shift all revenue needs to import tariffs, waving goodbye to income taxation for good. The president has wide leeway to enact tariffs on his own, and whatever he plans to do would probably be handled outside the TCJA extensions.

So Congress could just include a line–in a report or resolution–that the TCJA extension will be paid for with future tariff revenues, and leave it at that.

The catch is that the reconciliation process requires passing a budget resolution before-hand, including a revenue window. (This goes back to the original idea, that it be used to “reconcile” an annual budget to changes that happen throughout the year. But as the filibuster has forced a 60-vote threshold in the Senate for nearly all legislation, reconciliation has become the common tool to pass anything budget-related.)

No matter how the rest of the vote-counting goes, Republicans will only have a single-digit majority in the House. Can the party get virtually all of its members to approve a budget resolution authorizing more than $4 trillion in new debt? Trump has shown he doesn’t care much about deficits, and many Republicans in Congress view lower taxes as a goal in their own right. But there are still enough deficit hawks to make this a problem.

Once a revenue limit is added to the mix, it gets a lot stickier. When it’s a matter of trillions of dollars, it’s not money you can get by looking under the couch cushions and scrubbing the bureaucracies of waste. (No matter what Trump said on the campaign trail.)

An obvious place to look is the Inflation Reduction Act, which authorized $900 billion in new spending, largely on clean energy production. No Republicans voted in favor of that bill, and many have decried it as a giveaway to wealthy interest groups. But it’s also spending that is spread out among many Congressional districts, and many lawmakers of both parties will not want to see those projects and jobs evaporate. Furthermore, corporations have heavily invested in projects that depend on those credits–they won’t be happy about a repeal either. Mustering a full majority could be difficult here as well.

Any way you approach it, you run into the slim Republican majority as a potentially insurmountable obstacle. There are Republicans in wealthier areas like New York and California who will insist on removing the $10,000 limit on deductions for state and local taxes as part of any deal–raising the price tag even more. Republican leadership may not be able to afford losing their votes, but can they afford buying them back? (And this isn't even getting into Trump's proposed tax cuts for things like tips or lowering the rate to 15%)

The brutal arithmetic here opens the door slightly towards some bipartisan agreement. But the mood in Washington has hardly ever been less favorable to cooperation, and Democrats would likely be happy to watch Republicans fail to fix their own bill. The consequences of failing to act–such as a reduction in the standard deduction that many middle-income taxpayers have come to rely on–could be enough to provoke some action, however. Who knows, maybe even the OECD deal could be back in the mix–although it doesn't raise nearly enough revenue to fix all of these problems.

There will almost certainly be some significant international tax changes to the U.S. code in the next year. But the road from here to there is still unclear and unmapped.

DISCLAIMER: These views are the author's own, and do not reflect those of his current employer or any of its clients. Alex Parker is not an attorney or accountant, and none of this should be construed as tax advice.

A message from Exactera:

At Exactera, we believe that tax compliance is more than just obligatory documentation. Approached strategically, compliance can be an ongoing tool that reveals valuable insights about a business’ performance. Our AI-driven transfer pricing software, revolutionary income tax provision solution, and R&D tax credit services empower tax professionals to go beyond mere data gathering and number crunching. Our analytics show a company’s tax position impacts the bottom line. Tax departments that embrace our technology become a value-added part of the business. At Exactera, we turn tax data into business intelligence. Unleash the power of compliance. See how at exactera.com.

Thanks for reading! Don’t forget, you can sign up here for a paid Emperor Subscription, to get extra bonus content, including interviews with newsmakers in the tax field and deep dives on various international tax topics.

The Emperor Subscription will also give you access to past content, such as interviews with former OECD tax chief Pascal Saint-Amans, M.I.T. accounting professor Michelle Hanlon, and former U.S. Treasury official Jason Yen. (Here's a full list of past Emperor Subscription content.)

This Friday, I look into Mexico's maquiladora regime.

The transactions are handled by Stripe, a safe and secure payment processing platform. Electronic receipt and invoice available. (If anyone has any difficulties subscribing, please let me know.)

You can sign up here for $8/month or an $80 annual payment. Please consider subscribing!

I mentioned this before, but since this summer I've been working as an independent consultant/freelancer on international tax issues. If you think I might be able to help you--with writing or advice on these topics, for instance--please let me know, you can reach me at amparkerdc@gmail.com.

LITTLE CAESARS: NEWS BITES FROM THE PAST WEEK

- All eyes in the tax world are also on Treasury, as Trump makes new Cabinet announcements surprisingly soon after his electoral victory. In his first term he tapped billionaire investor and Hollywood producer Steven Mnuchin, who served as Treasury Secretary for all of the first term. It appears he’ll likely look to Wall Street again, as the names which have been floated so far all come from his close circle of ultra-wealthy economic advisors. The front-runner appears to be Key Square Group founder Scott Bessent, but there are rumblings in Trump-world that he’s not a true believer on tariffs, which would be fatal to his chances. The underdog is Cantor Fitzgerald CEO Howard Lutnick, who appears to be a full-throated champion of Trump’s protectionism. You can see him here in an October Bloomberg TV clip, in which he claims that Trump’s plans would force Apple to move its factories home, and nix its Irish tax structures. (I'm not 100% sure how.)

- Speaking of Pillar Two, Republicans have been quick to declare its demise following their November victory. Rep. Kevin Hern, R-Okla., one of the biggest P2 critics in Congress, reportedly pronounced it “dead on arrival.” But it’s still not totally clear how the U.S. could prevent other countries from continuing to support the system, or to repeal the Pillar Two legislation they already have in place. Republicans will no doubt ready legislation to retaliate against countries which use the Pillar Two undertaxed profits rule to tax American businesses, (possibly as part of the TCJA package), and Trump already has plenty of tools at his disposal. But with Trump all but certain to start trade wars on a plethora of issues, how much will this one matter?

- The OECD released its 12th annual “Tax Administration Series,” with information about national tax administrations meant to “be used by tax administration analysts allowing them to understand the design and administration of tax systems in other jurisdictions and to draw cross-border comparisons.” One interesting tidbit–it includes a section about different methodologies for the “tax gap,” or the difference between revenue and how much could theoretically be raised with ideal enforcement and policies.

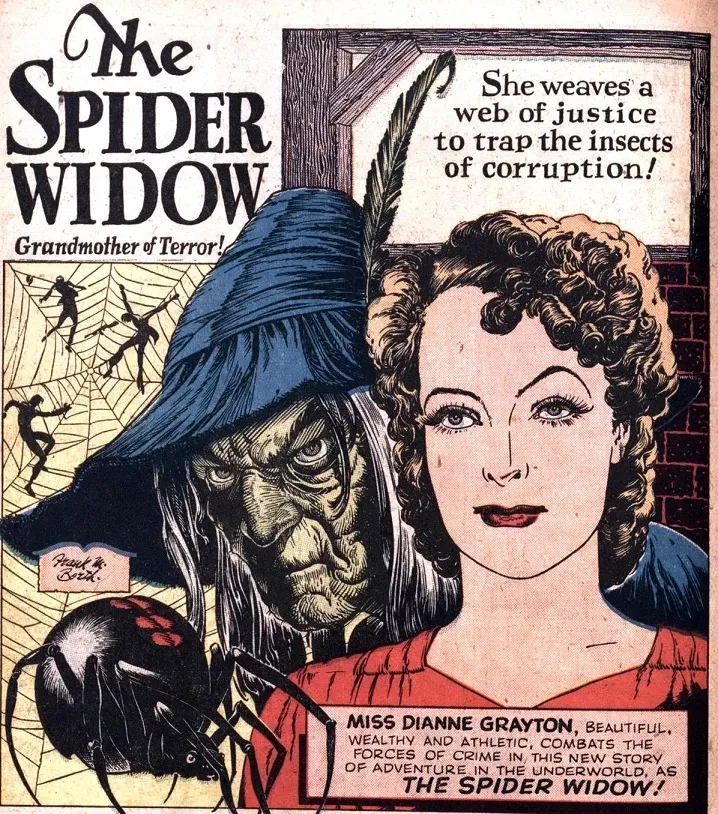

PUBLIC DOMAIN SUPERHERO OF THE WEEK

Every week, a new character from the Golden Age of Superheroes who's fallen out of use.

The Spider Widow, appearing first in Feature Comics #57 in 1942. The "Grandmother of Terror," Dianne Grayton, bored with the life of a wealthy socialite, donned a Halloween witch costume and set out to terrify criminals and dispense justice. She apparently kept pet spiders she can command at will, which is pretty terrifying. Her rival is, appropriately, the Spider Man. (No not that one.)

Contact the author at amparkerdc@gmail.com.